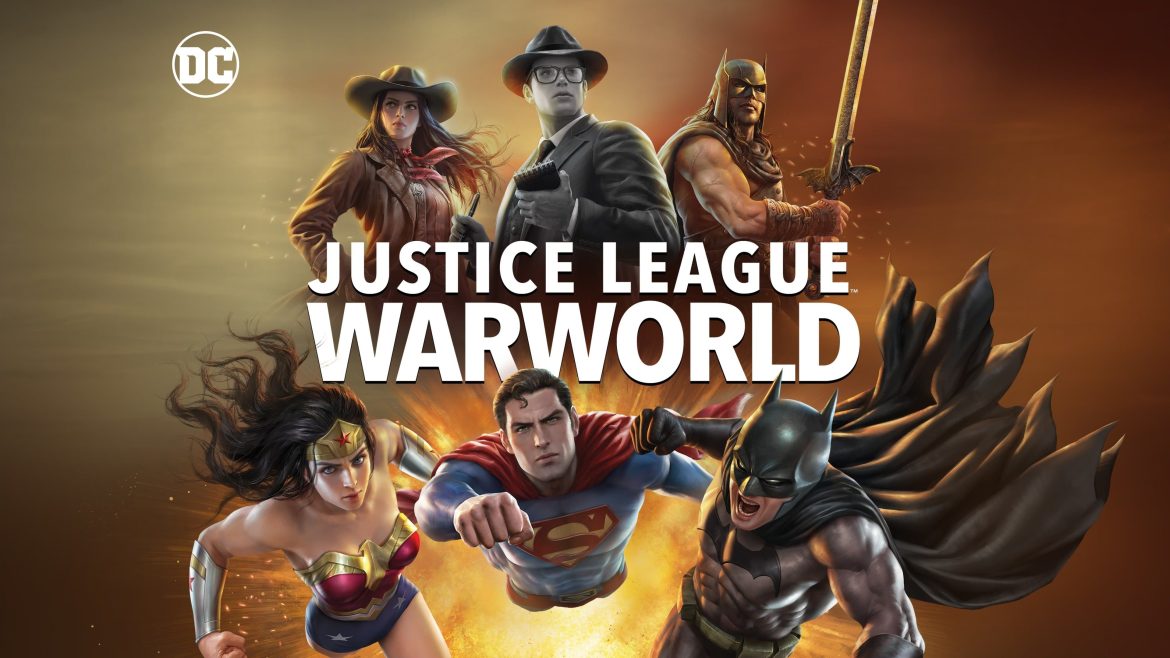

Overview: The newest DC animated movie, Justice League: Warworld (2023), sees Batman, Superman, and Wonder Woman fight their way out of different worlds with no memory of how they got there.

Synopsis (Spoilers ahead): The Trinity (Batman, Superman, and Wonder Woman) is separated, and the movie opens with Wonder Woman in the old west. She teams up with Bat Lash, and they work together to liberate a town from Jonah Hex. Wonder Woman and Bat Lash are able to stop a train that Hex has coming in with illegal items on it. After the pair stop the train, Hex kills Bat Lash, which causes Wonder Woman to snap and beat Hex to a pulp. Wonder Woman then gets on her horse and rides out of town.

Next, we find Batman on the world of Skartaris battling the Warlord. Warlord is able to capture Batman. On this planet, Batman is a mercenary who does not fight for justice. Warlord needs Batman, however, to lead him to the castle of Deimos. While there, Warlord figures out that Batman has been working for Deimos, and Batman traps Warlord. Batman then confronts Deimos. During his confrontation, he spots Wonder Woman but is confused as to how the two heroes know each other. Warlord reappears, after having killed the monster that ensnared him, and together, all three take down Deimos. Batman and Wonder Woman know that this world is not theirs and decide to leave.

Then, we see Clark Kent meeting with King Faraday at a 1950s diner to interview people about a possible alien sighting. Clark sees Bruce Wayne and Diana Prince there, and once again, each hero senses that they know each other. It is revealed that the citizens they were talking to are White Martians, and the Trinity makes a run for it. The three heroes end up at the mothership and see Martian Manhunter captured and hooked up to a machine. Manhunter reveals that for months they have been help captive, and he has been creating the illusions of their worlds for Mongul.

The Trinity encounter a room full of clones and people taken from various realities. They also find their costumes, but still, they have no memories of who they really are or how they got to Warworld. Meanwhile, Mongul is searching for a key that the Martians have to break open the multiverse. Manhunter and a White Martian form as one, as they are the key, and end up destroying Mongul’s world.

Before the ship blows up, a mysterious figure grabs Batman, Superman, and Wonder Woman and tells them that they are needed for a “crisis” that is coming.

Analysis: A Crisis on Infinite Earths movie was just announced, so Justice League: Warworld was clearly a lead into that follow-up. Honestly, I don’t understand how. Nothing really happens in this film. At the end of Legion of Super-Heroes, (2023), we see Batman and Superman kidnapped, but we never see Wonder Woman kidnapped. I also think that this Wonder Woman is the Wonder Woman that we saw in Justice Society: World War II, which took place on Earth-2 because she makes a comment at how this Clark is younger than the Clark she knows. So is there a Wonder Woman on Earth One? Or will the upcoming “Crisis” put all the worlds together?

The voice cast is fine. I actually really like Jensen Ackles as Batman and hope we see him lead another Batman solo movie again. Darren Criss and Stana Katic are back as Superman and Wonder Woman, but none of the actors get to do much as the characters because they are playing alternate versions of themselves basically. It’s uninspiring, and frankly, it’s not a movie that gets me excited for a sequel.

Editor’s Note: Justice League: Warworld is now available on Digital HD, Blu-ray, and 4K Ultra HD. You can order your copy and help support TBU in the process by heading over to Amazon.

Justice League: Warworld (2023)

Overall Score

1.5/5

This was a miss. DC Animation has been taking some interesting ideas and inspirations with their films lately, but for this to be the movie that leads into Crisis on Infinite Earths, I just don't buy it. Nothing happens, and it's a pretty dull setup.